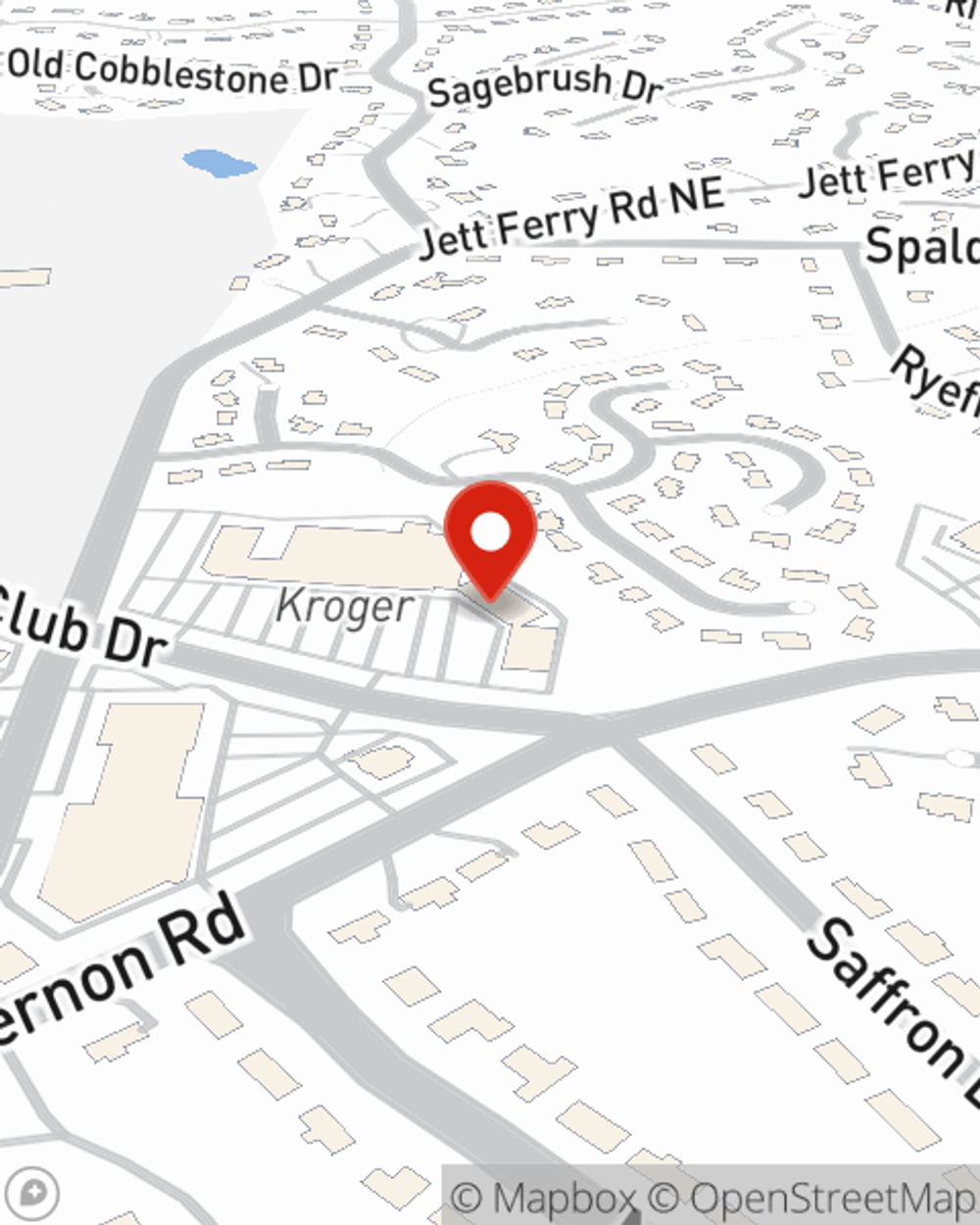

Business Insurance in and around Sandy Springs

Calling all small business owners of Sandy Springs!

This small business insurance is not risky

Help Protect Your Business With State Farm.

Owning a business is about more than making a profit. It’s a lifestyle and a way of life. It's a commitment to a bright future for you and for those you love. Because you give your all to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with business continuity plans, extra liability coverage and a surety or fidelity bond.

Calling all small business owners of Sandy Springs!

This small business insurance is not risky

Customizable Coverage For Your Business

At State Farm, apply for the excellent coverage you may need for your business, whether it's a drug store, a pet groomer or an art school. Agent Philip Cohn is also a business owner and understands your needs. Not only that, but customizable insurance options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage takes the cake.

Call or email agent Philip Cohn to review your small business coverage options today.

Simple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

Philip Cohn

State Farm® Insurance AgentSimple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.